Module 9: The Data Ecosystem, Asset Management, and Conclusions

Module 9 Description

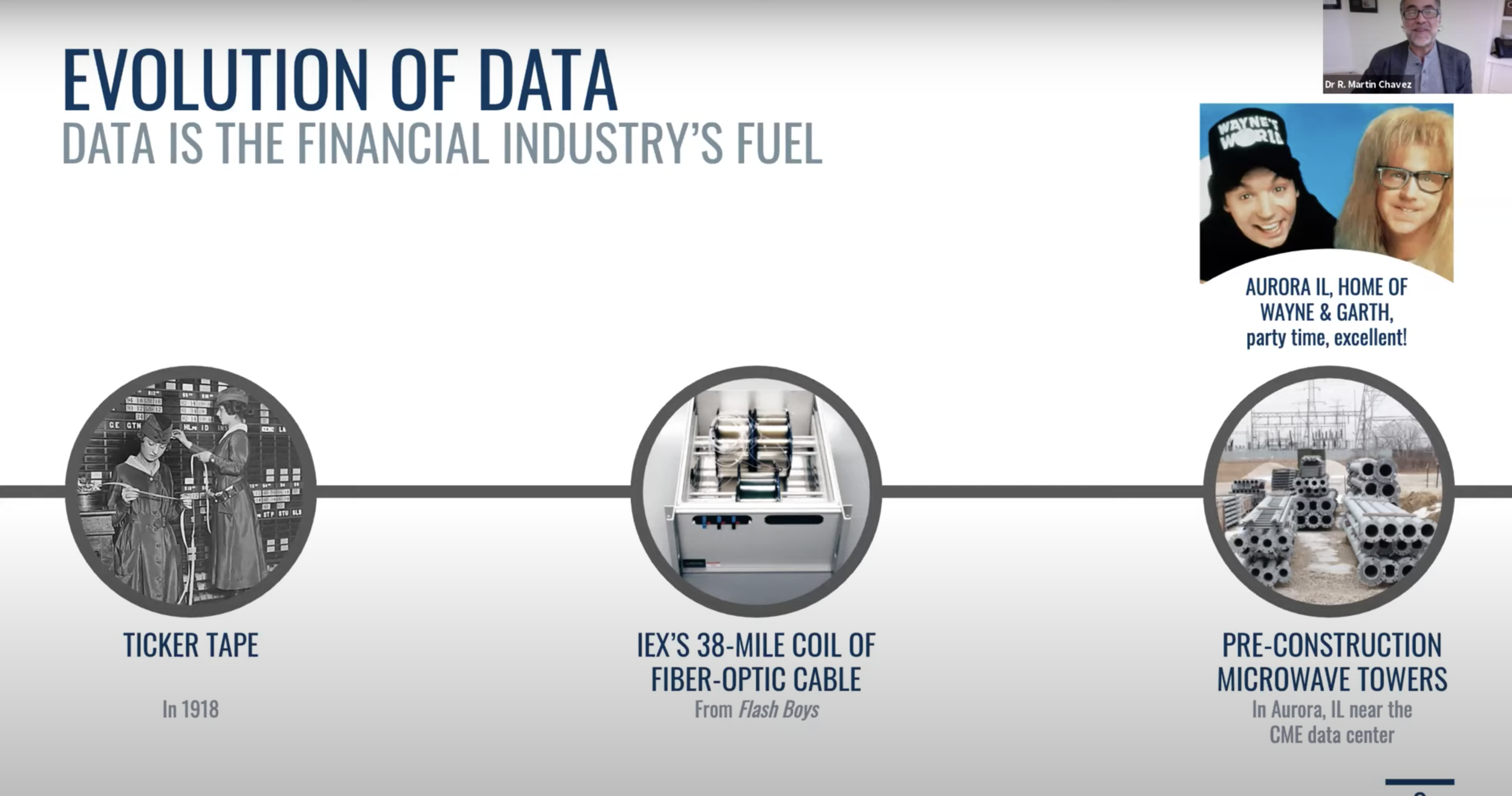

First, we review the current tangled state of data across the financial ecosystem. Who owns the data? Who creates it? Who distributes it?

Next, we offer an overview of the asset-management industry, according to this taxonomy of firms:

Long-only asset managers

Hedge funds

Systematic / quantitative fund managers

Private equity managers, including venture capital

We review trends for each group, and consider the future evolution of the industry along API boundaries.

We conclude with a review of the financial ecosystem, evaluating the current state of APIs and enumerating the risks and opportunities for new APIs and business models.

Recorded Lectures

Study Questions

To what extent has Symphony emerged as a viable competitor (or alternative) to Bloomberg? What might the planned LSE/Refinitiv combination signal for the future of independent financial data (and/or communications) providers?

Do you agree or disagree with the undertones in the FT article that a risk management system of Aladdin’s scale holds systemic importance? How should regulators monitor the platform? Do you buy the thesis that a widely accepted, uniform risk modeling platform might lead to increased ‘herd’ behavior and system fragility?

If data is the new oil, what new opportunities (beyond those discussed in the lecture) might exist to provide data and analytics to the asset management industry? What opportunities might exist for asset managers to monetize their data? What are the potential trade offs or conflicts that might emerge from this new revenue stream?

In his recent biography, Blackstone founder Steve Schwarzman wrote: “The most important asset in business is information. The more you know, the more perspectives you have and the more connections you can make, which allow you to anticipate issues.” Why have private-equity firms been relatively slow to replace their millions of excel spreadsheets with a convergence of software and business processes? What has prevented them from building unified data and modeling platforms for their businesses? Will a third party solution (such as eFront) emerge to gain ubiquity in the industry (think ‘MS Office’ for PE), or will the software landscape remain fragmented (and largely empty)?

If you were creating a hedge fund, long-only asset manager or PE fund from scratch and possessed ample development resources, how would you approach the software and business design of your fund?

Reading List

Required

(Re-read/skim from Class 5) Lunden, Ingrid. Symphony, a messaging app that’s been a hit with wall street raises $165M at a $1.4BN valuation, Techcrunch, 12 June 2019.

(Re-read/skim from Class 5) Noonan, Laura and Szalay, Eva. Symphony will not go public until it is profitable, says chief, Financial Times, 13 October 2019 (Available behind Paywall).

“Creating a Financial Markets Infrastructure Leader of the Future [LSE’s presentation on proposed Refinitiv Acquisition] (slides 3-25).” London Stock Exchange Group, November 2019.

Henderson, Richard. “BlackRock's Black Box: the Technology Hub of Modern Finance.” Financial Times, 24 February 2020 (Available behind Paywall).

BlackRock. BlackRock Aladdin, Aladdin for Institutional Investors, Aladdin for Wealth Managers

Whyte, Amy. The Relentless Ambition of BlackRock’s Aladdin, Institutional Investor, 20 May 2020 (Available behind Paywall).

BlackRock. BlackRock to Acquire eFront – Industry Leading Alternatives Investment Software Provider, 22 March 2019

Demos, Telis. “Bloomberg in 2020: The Buyout, Not the Candidate.” The Wall Street Journal, 2 December 2019 (Available behind Paywall).

Optional

Financial Information eXchange, Wikipedia, Wikimedia Foundation.